Before investing in a stock, you need to know if it’s available at the right price: a price that reflects its Intrinsic Value. Intrinsic value essentially means a value based on things the company has that generate value (read profits, cash flows, or replacement cost of all its value-generating assets) and not on external things. This is quite difficult to assess very accurately; there can only be estimates. There are different methods to estimate Intrinsic Value that work in different situations. Since we are assessing a listed company, i.e. an established company and not a start-up, the most relevant method is the Discounted Cash Flow, or simply the DCF method.

If you were to buy the whole company, what price should you rationally pay for it?

You would look at the cash it would be able to give you every year and add it up. But you can’t simply add up cash generated in different years, because of Rs. 100 today is not the same as Rs. 100 one, two, or three years later. So, you have to reduce the value of the cash generated in the future years by a factor, to make it equivalent to its value today or its Present Value.

This is the money you earn while you own the company. And suppose you decide to sell it after a fairly long time, you would get some money for it based on what is called the Terminal Value. All this depends on the company’s ability to generate cash flows or simply profits, and hence, its intrinsic value too.

Now, as a Retail Investor, you own some shares in a company, but you can apply the same principle as above to arrive at the Fair Value of the stock. It is a bit different from its Intrinsic Value, but we can approach it in a rational manner. We, at MoneyWorks4me, prefer to call this the MRP or Maximum Retail Price of a stock.

The Fair Value of a stock relates to the returns that investors expect to receive from holding the stock. So, to arrive at the right value of a stock, you need to look at the future returns you will get by investing in a stock, and then discount them to arrive at its Present Value using an appropriate rate of discount.

Suppose you have invested in a stock, keeping a long-term holding period in mind. You earn income or returns from this investment in two ways, i.e. (a) Future Dividends (which you will receive every year) and (b) Future Selling Price.

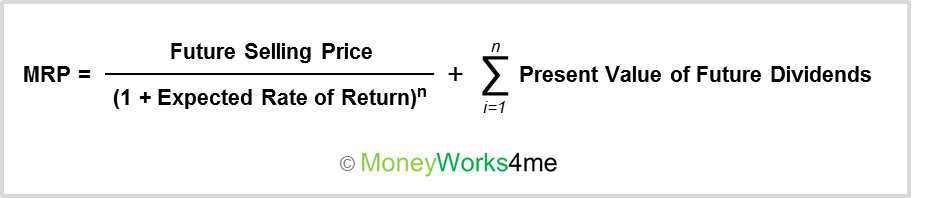

Hence, the Fair Value of a stock, i.e. the MRP, can be calculated as

- Future Selling Price: It is the price that you will receive when you sell the stock in the future. Here, you will benefit if the stock price appreciates. Now, the Future Selling Price, say 5 years ahead, will depend on the EPS then and its PE multiple. Future EPS is what Equity Analysts estimate by making projections of the company’s earnings into the future. They track if their assumptions are correct, or whether they need to be changed or fine-tuned. The PE multiple that you can expect, say 5 years from now, is again an estimate. The rational PE multiples depend strongly on the EPS growth rate. They can also be estimated from the long-term average the market has paid so far, and moderated if the future growth rates are lower than the past. The future earnings growth of the company depends on two factors:(1) The prevailing market conditions: Whether the company is present in a growing or stagnant industry and how the economy is growing.

(2) The company’s own capability to grow and take advantage of the opportunity: This can be gauged by looking at its sales earnings, gross margins, and book value growth rates in the past (y-o-y and CAGR), and how efficient it has been at using Capital Average Return on Invested Capital (ROIC). - Present Value of Future Dividends: These are the Dividends that you will receive in the future. It can be calculated by using the historical Dividend per Share and growing it at the rate at which you expect the Dividends to grow. We calculate the Future Dividends for each of these years, and then discount them to the present year, and add them.

- Expected Rate of Return: This is the Rate of Return that you expect to earn by investing in a stock. At MoneyWorks4me, we have taken this as the Cost of Equity (CoE) of the respective companies. Cost of Equity is the minimum required Rate of Return that investors expect when they invest in a stock and take up the associated risk.

- Holding Period (n): We consider it as 5 years when we calculate every stock’s Fair or Right Value.

To summarize, MRP is the maximum price you should pay for a stock, so as to get a minimum expected rate of return (CoE for that stock), every year for the next 5 years.

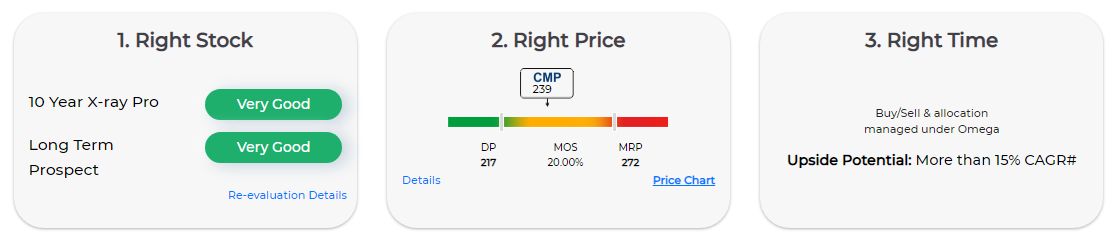

However, our MRP is based on estimates; also, the stock market may behave irrationally in the short term. So, how do you protect your investment from this irrational behavior or from your estimates going wrong? The answer is to look for a Discount or Margin of Safety. Hence, the principle we follow is: Always buy stocks at lower than their MRP. How much lower depends on the various factors discussed earlier.

You can get MRP & DP for Top 200 stocks with our Superstars Plan; click to know more. Also, see the Demo of how Superstars helps you to get three things right for your Stock Investment: Right Stock, Right Price, and Right Allocation!

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: